Article by Giulio Cattaneo

Introduction:

Over the past two decades, Italy’s economic growth has been minimal, with sluggish labour productivity playing a critical role in this slowdown.

Labour productivity measures the amount of output generated per hour worked. When productivity increases, more can be produced in the same amount of time, creating additional resources that allow, for example, to raise salaries, foster innovation, and support sustainable growth by using fewer inputs.

To better understand Italy’s productivity challenge, it is essential to examine the close connection between productivity, enterprise size and the sectors in which these enterprises operate.

Productivity Analysis by Size: A European Comparison

For decades, and still today, it has been widely believed that the strength of the Italian economy lies in its small and medium enterprises. Data shows that being small can actually be advantageous, but this is true only up to a certain threshold.

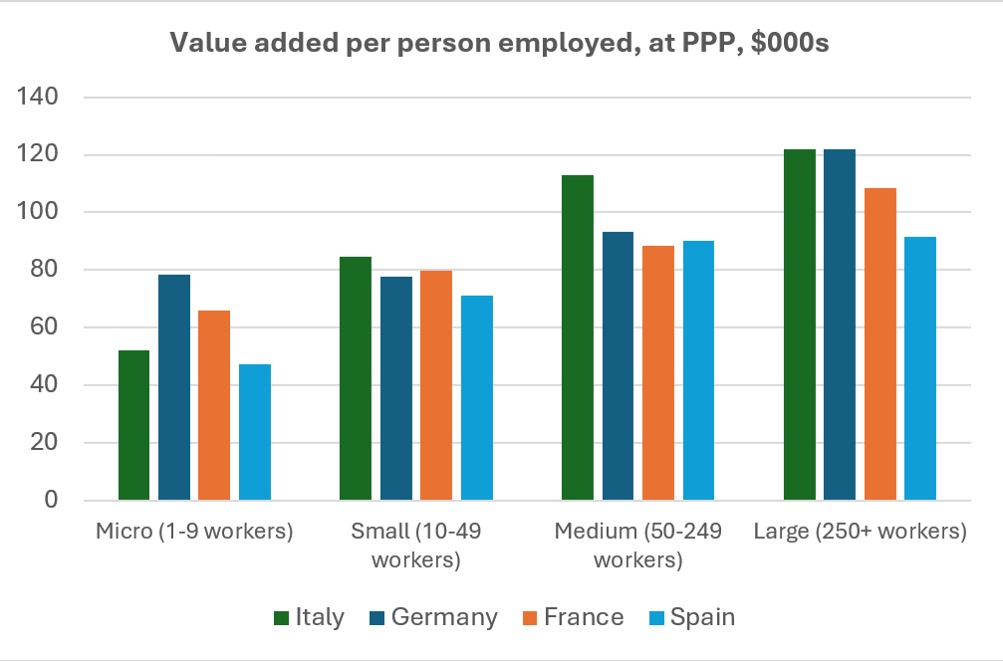

From 2003 to 2023, productivity in Italy grew by only 2,5%, compared to 9,7% in France, 16% in Germany, and 18% in Spain, with an average growth across Europe of 19,6%. However, if we compare the average productivity of Italian enterprises by size, with those in Germany, France and Spain, we find that large Italian enterprises (250+ workers) are among the most productive, on par with German ones. Medium-sized Italian enterprises (50-249 workers) lead in their category, far outperforming others, and also small Italian enterprises (10-49 workers) show the highest productivity. Instead, when it comes to microenterprises (1-9 workers) the situation changes drastically. Compared to their European counterparts, except for the Spanish ones, Italian microenterprises are considerably less productive.

Source: processing of data from OECD Compendium of Productivity Indicator

This result is even more concerning, considering that 95,2% of the Italian total enterprises are micro, and they employ 43,2% of the total workforce, significantly impacting Italy’s overall productivity (ISTAT, 2022). Reasons behind the low productivity of microenterprises include minimal investments in innovation, R&D and digitalization. Moreover, these businesses also tend to have poorly structured processes and generally less-experienced management, in addition to not being able to benefit from economies of scale.

Beyond the low competitiveness of Italian microenterprises, we can also observe that the productivity increases significantly as the size of the enterprises grows; large enterprises, for instance, are more than twice as productive as microenterprises.

The key point is that in an efficient, competitive market, the less productive enterprises would fail, and their resources would be reallocated to more productive firms, but this doesn’t happen in Italy. These unproductive enterprises are still able to survive in the market, likely due to state aids, fiscal incentives, or tax evasion. Indeed, it is also important to consider that the rate of tax evasion among microenterprises is the highest among all business types, making their large presence even more detrimental for the well-being of the Italian economy.

Sectorial Productivity comparison:

To date, when it comes to identifying the primary economic drivers of Italy, the belief that “small is better” seems widely accepted, along with the idea that the tourism or construction sectors play a crucial role in this context.

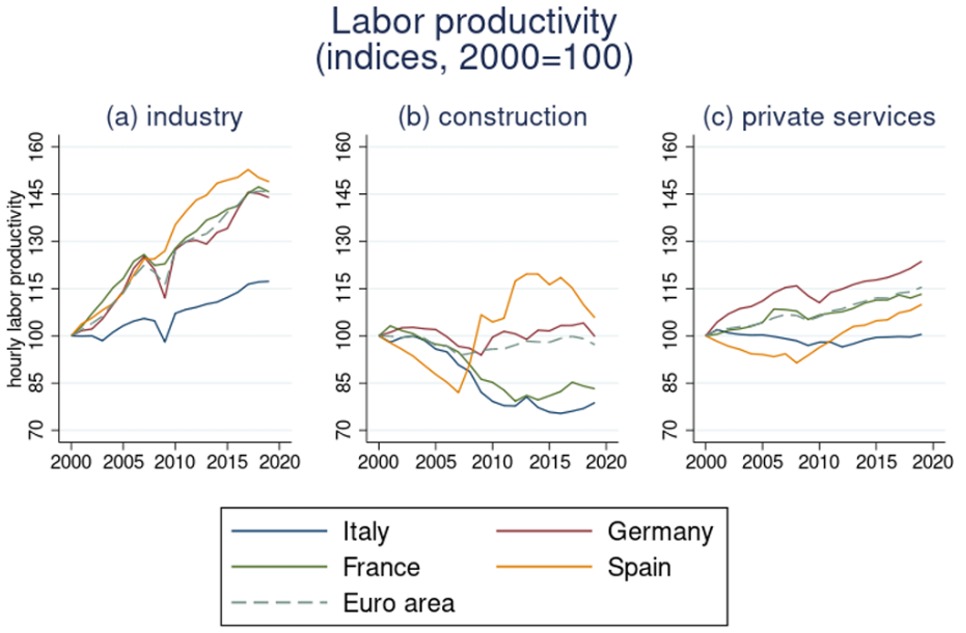

But is this really the case? As mentioned, the sector in which enterprises operate significantly influences productivity. Over the past twenty years, for example, the productivity per hours worked in the manufacturing industry grew by 21,4%, compared to -14,1% in the construction sector and -26,6% in the accomodation and food service sectors.

Indeed, in manufacturing productivity can increase by using the same resources more efficiently, thanks to advancements in technology and machinery. On the other hand, in service industries, such as restaurants, the added value per person cannot increase significantly due to the limitations in how services are delivered.

Source: Bank of Italy, A structural Analysis of productivity in Italy: a Cross-Industry, Cross-Country perspective

We can observe that, although the manufacturing sector is growing, it remains below the levels of our European partners. However, it becomes clear that the solution to boost productivity lies in investing in high-value-added sectors, such as manufacturing industries, along with R&D, to advance technology and increase international competitiveness. It is also evident that public spending in the construction sector has limited economic effectiveness. For instance, The Superbonus and Bonus facciate, which required around 170 billion euros in public spending and were focused on the construction sector, may temporarily increase employment, but they do not enhance productivity. As a result, public debt rises, and the underlying productivity problem persists even after the program ends, leaving the Italian economy lagging behind.

Conclusion:

The mechanism that drives economic growth is the one in which competition eliminates inefficient businesses, replacing them with more efficient ones; however, this mechanism is broken in Italy.

Moreover, Italy also faces additional challenges, such as an excessive bureaucracy, an unsustainable pension system, high taxes, and issues in educational quality. In this complex scenario, investing in innovation and high-value-added sectors, as well as supporting the growth of the micro and small enterprises, are essential steps to reverse Italy’s economic stagnation, improve the country’s international competitiveness, and retain its brightest talent, who are increasingly seeking opportunities abroad.

OECD, (2024). Compendium of Productivity Indicators 2024. Retrieved 14/11/2024, from https://www.oecd-ilibrary.org/industry-and-services/oecd-compendium-of-productivity-indicators-2024_b96cd88a-en

Bank of Italy, (2023). A structural Analysis of productivity in Italy: a Cross-Industry, Cross-Country perspective, No. 825. Retrieved 14/11/2024, from https://www.bancaditalia.it/pubblicazioni/qef/2023-0825/QEF_825_23.pdf

ISTAT, (2022). Annuario Statistico Italiano. Retrieved 14/11/2024, from C14.pdf